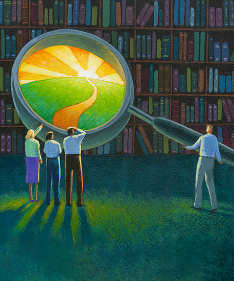

McLellan Finance provides tailored commercial finance solutions, empowering you with buyer control. We streamline the process of securing market-tested, competitive funding. Whether you’re acquiring property, purchasing a business, expanding operations, or conducting a financial review, we advocate for your best interests. Let’s connect—onsite, at our office, or over the phone.

Stay informed with the latest insights and expert advice on finance and industry trends. Explore our articles, tips, and updates to help you make informed decisions. For more in-depth information, visit our full Insights page.

Finance | Commercial | Video

3 Feb 2025

Finance | Commercial | Video

3 Feb 2025

Finance | Article | Commercial

6 Feb 2025

Find quick answers to common finance questions. Explore our FAQs below, and visit our full FAQ page for more details.

Commission from lenders – In most cases, we are paid directly by the bank when a loan is successfully settled. This includes an upfront commission based on a percentage of the loan amount, as well as an ongoing trailing commission for the life of the loan. This structure means our service is typically at no direct cost to you.

Advisory or success fees – In certain cases, we may charge an advisory fee, which could be a fixed amount, an hourly rate, or a success fee based on a proportion of the benefit received. These scenarios are less common and will always be discussed and agreed upon with you upfront.

Achieving the best-priced or most valuable deal depends on several factors, which can be grouped into five key categories:

While banks may offer direct pricing, they are ultimately focused on their own interests. A skilled broker works for you, leveraging their knowledge and lender relationships to ensure you receive the most competitive terms available.

At McLellan Finance, we offer more than straightforward transaction structuring and negotiating competitive financing solutions—we provide strategic advantages that enhance your financial position over the long term:

By working with McLellan Finance, you gain a trusted partner dedicated to securing the best financial outcomes for your business while providing valuable insights and strategic guidance along the way.

At McLellan Finance, our commitment to clients extends well beyond deal completion. We maintain an ongoing relationship through quarterly on-site meetings, ensuring we continuously refine our understanding of your business, goals, and management approach. Acting as a strategic sounding board, we provide insights and guidance on early-stage ideas, helping you plan and position your business for future opportunities. Our proactive engagement ensures you remain abreast of the changing pulse of the finance industry and are well-prepared for your next move.

Our role extends beyond simply sourcing finance—we act as strategic advisors, ensuring you secure the right funding solution that aligns with your business objectives. We begin by gaining a deep understanding of your financial position, business story, and immediate borrowing requirements. From there, we structure a compelling funding proposal, leveraging our industry expertise and lender relationships to present your opportunity effectively.

Our approach follows a competitive tender-style process, where we engage with a curated selection of lenders to gauge appetite, pricing, and terms. Based on initial feedback, we refine the approach and submit a formal application to shortlisted funders, who undertake credit assessments and provide preliminary offers.

Once we present these offers, we guide you through the selection process, ensuring transparency and alignment with your strategic needs. Upon finalising the preferred funding option, we facilitate introductions to the lender, negotiate final terms, and assist in managing the transaction through to settlement.

By combining deep market insights, a rigorous funding process, and strong lender relationships, we maximise competition among financiers, delivering optimal funding outcomes with efficiency and confidence.